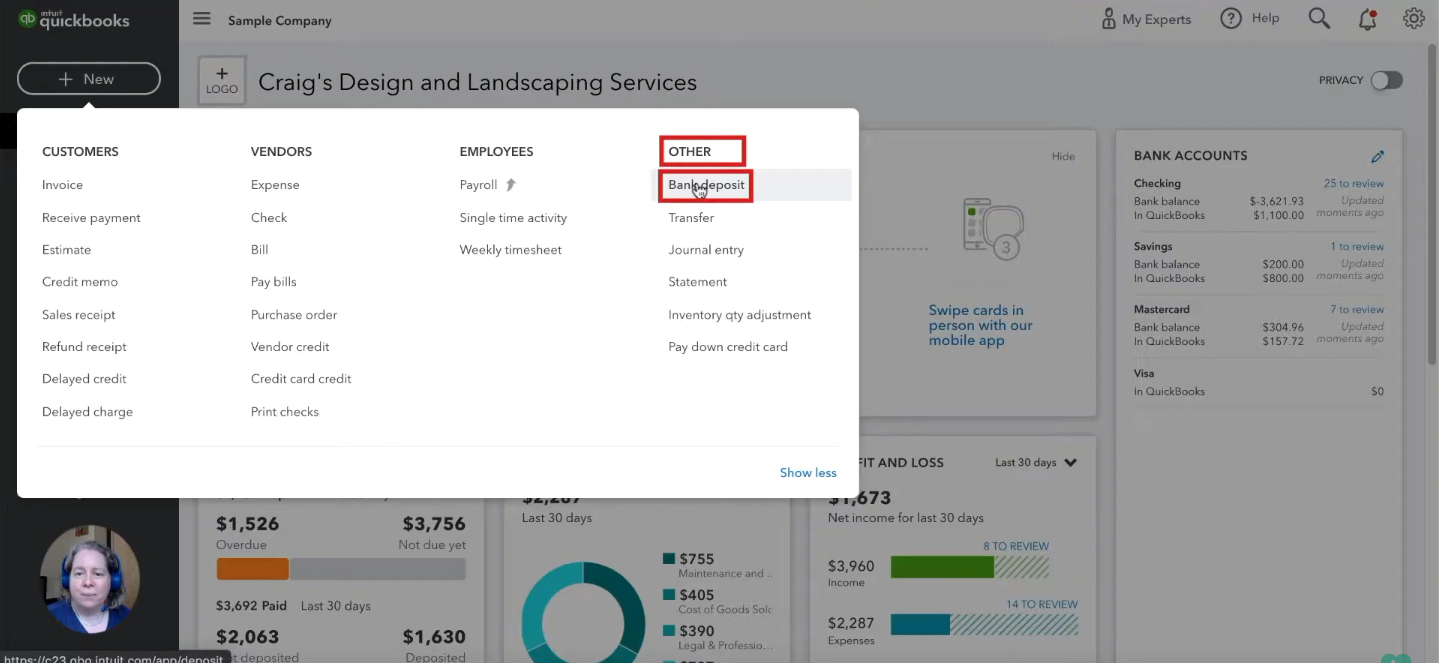

We have already created a deposit manually before connecting the bank account, so we can show you the process. Here is a sample deposit to match: What is this deposit that QuickBooks matched? Once you accept, they are moved to your bank account. You will be asked to accept these transactions. QuickBooks will populate a list of deposits and withdrawals from your bank account. You should see a button saying nothing has been added if you are a new user. Follow the on-screen instructions to add a bank account.To add the bank account feed, here are the steps: Without adding your bank feed, you must add the withdrawals and deposits one-by-one. For example, below is a screenshot of a bank register: You can view this account in QuickBooks by clicking the gear box and selecting chart of accounts. Bookkeepers and Accountants match the bank account and the QuickBooks register. QuickBooks has a copy of your bank account’s withdrawals and deposits. How do I connect my bank account to QuickBooks? To add fees, you must match them to a group of orders and deposits from your bank. You must add these fees as an expense, so you pay no taxes on them. Most processors take a commission of about 1-3% per transaction before they deposit. All of Monday’s sales are direct-deposited into your bank account by Wednesday. They typically deposit on a two-day schedule.

When you are paid online, a payment processor collects the funds and holds them in a staging area to clear. Your merchant account fees will be missing, so you are taxed on an expense. You must match deposits from your bank with QuickBooks orders. Why is it important to use a deposit matching tool?

#In quickbooks for mac match multiple deposits with one deposit software#

TIP: In the newer versions of the software it is possible to make a general journal entry to the undeposited funds account. That is the rational for the recommended approach of having the deposit date and receive payment dates match. The primary problem with this approach is that when the statements are issued, the account will appear in the Other Current Asset section, not with the bank accounts, and there is no way to change the account type. Some accountants choose to edit the name to “Cash on Hand” to clarify what this account actually is. To correct the situation, the deposit date should be changed to agree with the received payment, resulting in a deposit in transit on the bank reconciliation. During the interim, the amount will be in undeposited funds. The problem occurs when the money is entered one day and the deposit is made on a different day. The total of this deposit slip should agree with the bank statement at the end of the period. At that point, the make deposit function is completed in QuickBooks to pull the undeposited funds onto a deposit slip. At the end of the day, the drawer is opened and money is scooped up and taken to the bank. As the money comes in each day, it is entered into the computer, and placed in the top desk drawer.

The easiest way to picture this account is as the top desk drawer. Undeposited Funds is a special account created by QuickBooks as a clearing account for payments that have been received but not yet deposited into the bank account.

By admin Undeposited Funds on Balance Sheet

0 kommentar(er)

0 kommentar(er)